How You Can Start Investing In Your 20s?

- Kirti Rajput

- Feb 13, 2023

- 7 min read

Updated: Mar 4, 2023

If you’re going to start your investment journey while you’re in your 20s, then you must know you have time, which is the biggest asset.

Don’t know how, check this.

Imagine there are two investors who start earning in their 20s. But the first investor starts the investment with ₹10 thousand per month for an annual interest of 10%.

He invests consistently for 40 years and the final invested amount will be ₹48 lakhs. At the end of 40 years his portfolio amounts to ₹6.4 crore after calculating the interest.

This is called the power of compounding.

On the other hand, the second investor doesn’t invest for the first 10 years. He started his investing journey at the age of 30 years with an amount of ₹12 thousand per month for an annual interest of 10%.

At the age of 60 his invested amount will be ₹43.2 lakhs. Despite investing more, the second investor ends up with ₹2.7 crore wealth at the age of 60.

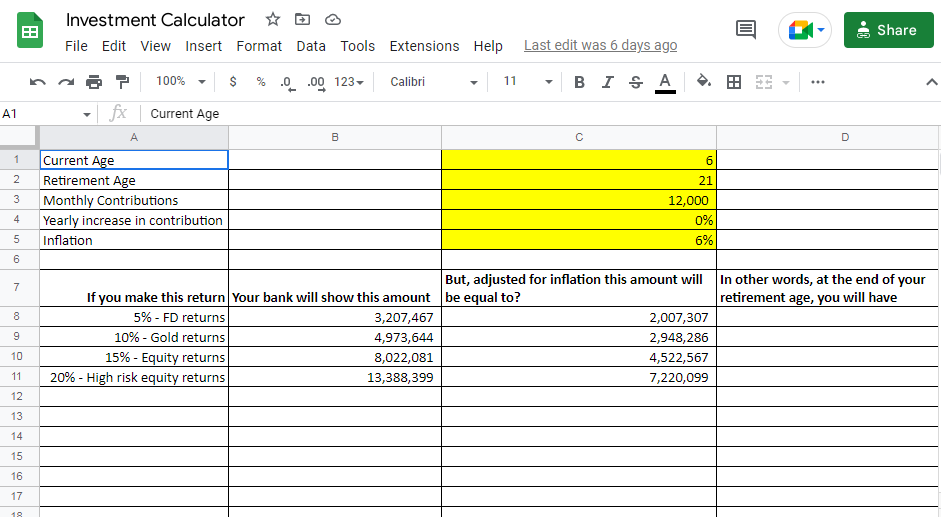

The main purpose of wealth creation is time and power of compounding. Check this sheet to know how much amount you will make by your retirement if you start investing today.

Download: Compound Interest Sheet

You will make the best-decision if you start your investment journey in your 20s. Here are a few things you should consider to create wealth:

[1] Set Financial Goals

Before investing, set a goal for which you will create all this wealth. This could be anything such as higher studies, buying a house, marriage, retirement, etc.

The reason behind your goal should be strong enough to push your investment to continue. You can set both short and long-term goals.

Short-term Goals

Short-term goals are those which are made for less than five years. For these goals amount should be kept in safer assets such as mutual funds and gold bonds because these assets have the liquidity to provide cash within 24 hours without any loss.

You can also keep this amount in the bank with a higher return than a normal savings account. Do not invest in the equity market for short-term goals, because of its volatile nature.

Long-term Goals

Long-term goals are always made for more than 5 to 10 years plans such as retirement.

A diverse portfolio is the best way to invest for the long-term. The best ways are:

Moderate to High Risk Mutual funds

Direct Equity

Gold Investment

Real Estate Investment

Have some exposure to riskier assets like stocks, because you will generate more interest than any other assets. But diversification is also very important. Don’t invest all your money into one riskier asset.

[2] Retirement Plan

Many say life starts at 60 this is because many of us retire at this age. To fulfil all dreams at this age we need some wealth which we can use to spend on expenses and enjoy our life without working for money.

Creating a retirement plan is the best way to live your life without worrying about money. There are multiple ways through which you can plan our retirement. Pick one or two from the below given options and start investing some amount from your salary.

National Pension Scheme (NPS)

Public Provident Fund (PPF)

Employee Provident Fund (EPF)

Insurance

These funds offer tax-free capital gain, income and interest. To get a good retirement amount in the end, at least move 3% of your income towards your retirement account. For example: if you earn ₹1,00,000 per month, then contribute ₹3,000.

If you don’t achieve this it means you leave a huge chunk of money on the table because compounding is implemented in every investment.

[3] Creating Emergency Fund

Creating an emergency fund before creating wealth is a smart move for unexpected expenses.

If you don’t have any prior amount and starting from zero, then move 10% of your investment to this account every month. Keep this amount in a tool where cash liquidity is higher such as mutual funds or bank account.

Higher liquidity ensures that you don’t have to wait for money in any tough situation. In general this amount should cover your minimum 3 to 12 months of expenses.

If you prepared this amount then it gives you confidence to invest in high riskier assets because now you are ready for any emergency.

Having some money for unexpected expenses also comes under the goal of financial independence. Creating an emergency fund should be your first goal over any extra investment.

Note: Keep your emergency fund in a bank account with a good interest rate. Keep this amount in an account which is not connected with your primary checking account because it reduces the chance of temptation to exempt that amount for non emergency purposes.

Have a Secure Future by Following These 5 Straight Investment Ways

Calculating the risk before putting any amount in any asset is always advisable. When you’re in your 20s, then you are able to take higher risk. In these years invest your more into equity and debt.

Here’s a formula to calculate a perfect divide between these two:

=> 100 - your current age = The amount you should invest in equity

The remaining amount you should be invest in debt

For example: Your current age is 21 years then the initial amount goes towards equity is 79% of your total investment and remaining 21% towards debt.

Here’s some options where you can move your money.

3 Different Options to Invest in Equity

Investment in equity includes purchasing stocks of a listed company. It shows your ownership in the company as per the amount invested.

Equity markets are considered the riskier assets because of their high volatility. But investors who are in their early 20s can take this risk to make high returns.

Check this NIFTY50 chart of the last 23 years. It shows that it gives a 1000% increase from the time it starts. For example: If you invest ₹5000 in the year 2000 then now it will be ₹55,000 (gain of ₹50000).

Source: Ticker Tape

High Interest Comes With High Risk

Before investing in equities check your risk analysis and make investments as per that ratio. Use the formula given above to calculate the perfect divide of your income between debt and equity.

Here are some ways to invest in equity market:

[1] Stock SIPs

Stock SIPs (Systematic Investment Plan) means investment in particular stock in small amounts at different time intervals. It can be monthly, quarterly or semi-annually.

It minimises the risk of investors by purchasing stocks at different prices at different time periods. By discipline and regular investment you can take advantage of market volatility without timing the market. Divide your SIP into different category stocks.

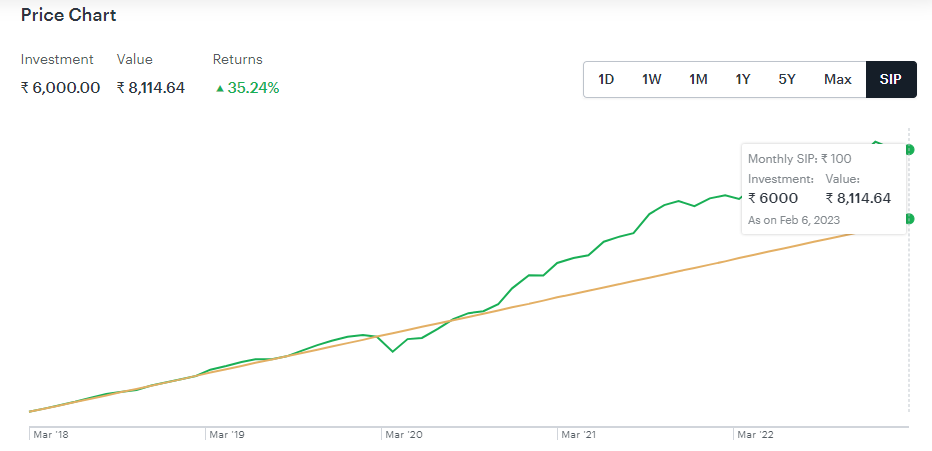

Again take an example of NIFTY50. How much would you have earned if you had invested 23 years ago?

Source: Ticker Tape

If you start your SIP journey with ₹100 from 2018 then after 5 years it will become ₹8,114 (total amount invested ₹6,000). SIPs are an amazing way to start your investment journey with small amounts.

[2] SIPs in Theme

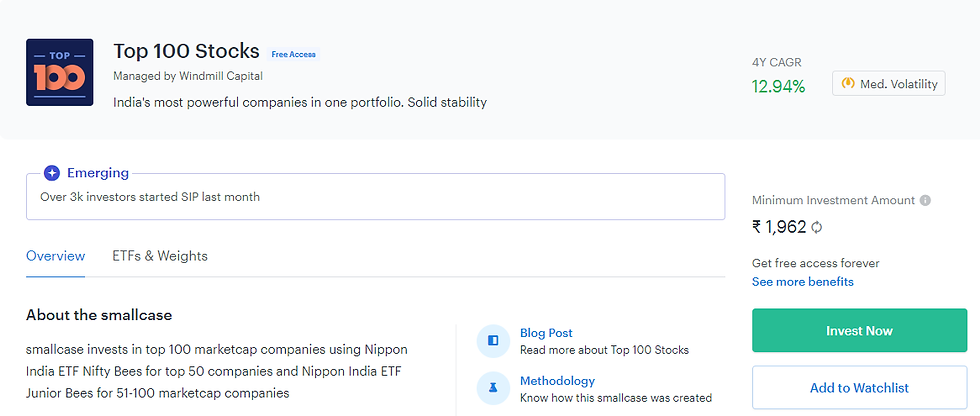

For those who don’t have faith in a particular stock but can invest in a theme. And SIP in themes means investing in small amounts among top 100 companies based on their market capitalization.

For instance, see this top 100 stocks which invest in Nippon India Junior Bees ETF and Nippon India Nifty 50 Bees ETF. The weightage is also clearly given.

Source: SmallCase

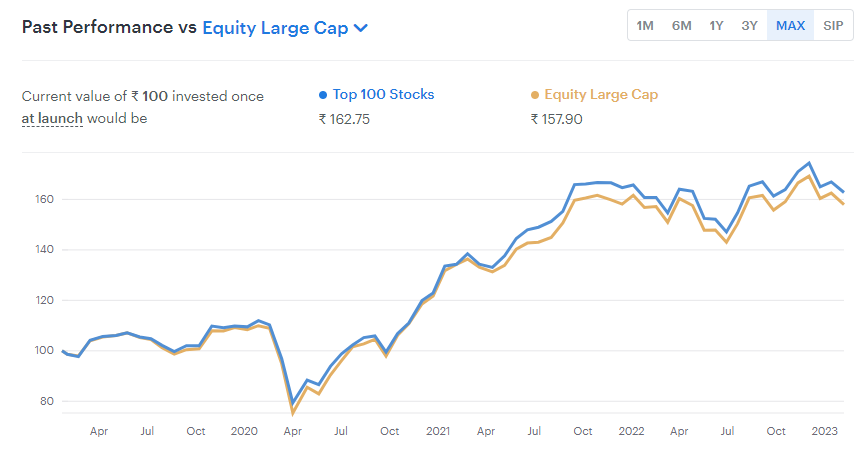

Source: SmallCase

Source: SmallCase

If we see the overview then it shows that this Top 100 Stocks smallcase has outperformed many equity large caps. With a minimum investment of ₹1962 both the purposes of investing in top 100 companies with low amounts and an interest rate of 12.94% all our purposes fulfil.

If you want to take a little higher risk then check this value and momentum small case. Investors who are in their 20s and ready to take a shade higher risk then must check this small case.

[3] Nifty BeES

If you want to invest in the overall direction of the market then invest in Nifty BeEs (Benchmark exchange traded schemes) or themes. Themes could be anything such as banks or gold.

For example: investors have a chance to invest in one bank or a mixture of banks. Here’s a picture of the current NIFTY 50 banks price vs. Nippon India ETF Nifty BeES.

Current Nifty Rate

Source: NIFTY 50 Index

Nippon India ETF Nifty BeES

Source: Nifty BeES

Investors can’t invest in NIFTY directly so you have to purchase futures and options which can be riskier for the short term and have a higher rate to purchase. It is currently trading at ₹17811.

On the other hand NIFTY BeES price is roughly 1/100th of actual nifty price. Which is currently ₹196 (way lower than nifty price)

Why should you invest in Nifty 50 BeES?

Get exposure to top 50 companies by investing comparatively small amount

Comparatively cheaper expense ratio

Higher transparency

Note: Index funds always perform a shade better than the index BeES because there are several expenses to handle BeES included. Invest in if you are starting with a low amount but with time try to expand your investment towards index funds.

2 Options to Invest in Debt

Lending money to companies or government bodies in return of fixed income and dividend is called investing in debt. Organisations use this money to grow and expand their businesses.

For instance: You invest ₹1,00,000 in a bond issued by XYZ company for 5 years at 10% interest and a half yearly payout. You will be entitled to receive ₹2500 as a quarterly payout for next 10 years.

The risk is low in debt instruments because at the time of liquidation debt owners are the priority over equity holders. Here is a detailed description of some of these instruments.

[1] Public Provident Fund (PPF)

The Public Provident Fund (PPF) has a 15 year lock-in period. In case of emergency, it only allows 50% of the total PPF amount accumulated in your account.

If you start a PPF account from your early 20s then it gives you a good time for lock-in and PPF account will mature much earlier than your retirement.

Once the 15 year lock-in period completes, the bank allows you to extend it for the period of 5 years. For example: If your current age is 21 and you invest in PPF then your account will mature when you are 36 years. At this time, if you don’t need money then put it back in for 5 more years. Now it will mature when you will be 41 years.

Investing in the early 20s gives a good time for lock-in without disturbing the investment.

[2] Gold Fund

Investing in gold gives a good portfolio diversification to investors. Here are five ways to make investment in gold:

Physical Gold

Gold ETFs (Exchange Traded Fund)

Gold Mutual Funds

Sovereign Gold Bonds

Digital Gold

From an investment perspective physical gold is not a good option. ETFs, gold funds, and SGBs are the best alternatives to invest in digital gold. For short-term choose Sovereign Gold Bonds and ETFs or funds for long-term perspective. These funds are safer options to invest with high liquidity and interest.

Final Thoughts

Start your investment journey, and this will be your best decision for your future. To jump into the market, you need a way to invest, and for me it's Zerodha. It’s a financial service company and it allows you to invest for a really small amount. Use the link to take a step forward in your wealth creation journey.

Open your demat account, through this link here. Zerodha Demat Account.

Comments